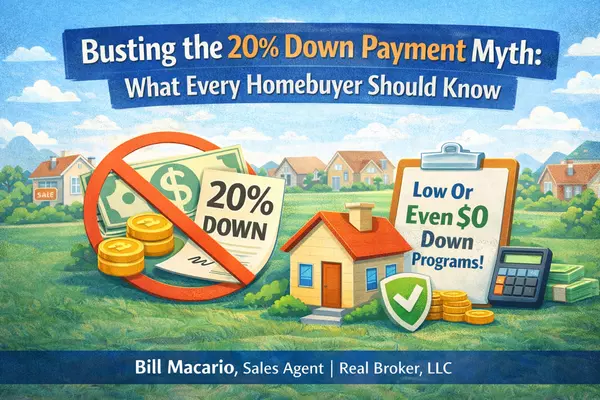

Busting the 20% Down Payment Myth: What Every Homebuyer Should Know

Busting the 20% Down Payment Myth: What Every Homebuyer Should Know

Let’s be honest—when it comes to buying a home, the idea of needing a 20% down payment can feel like a mountain standing between you and your dreams. For many hopeful buyers, that number is enough to hit pause on house hunting altogether. But here’s the truth: the 20% down payment is one of the most stubborn myths in real estate, and it’s time to set the record straight.

Where Did the 20% Myth Come From?

The 20% figure has been around for decades, rooted in traditional lending practices. While putting 20% down can help you avoid private mortgage insurance (PMI) and lower your monthly payments, it’s by no means a requirement for most buyers today. In fact, most first-time homebuyers put down much less.

Modern Down Payment Options

- FHA Loans: These government-backed loans allow qualified buyers to put down as little as 3.5%—a much more manageable number for many families.

- Conventional Loans: Some conventional loans now offer options for as little as 3% down, especially for first-time buyers.

- VA Loans: If you’re a veteran or active-duty service member, you could qualify for a VA loan that requires zero down payment.

- USDA Loans: Buyers in eligible rural areas can also take advantage of $0 down payment options through the USDA loan program.

What’s the Catch?

While low and no down payment programs can be game-changers, it’s important to understand the details. Lower down payments may mean higher monthly payments and mortgage insurance. But these costs are often manageable—and far preferable to waiting years to save up a huge lump sum.

Real-Life Example

Imagine you’ve found your dream home for $350,000. At 20%, you’d need $70,000 upfront—a daunting number for most. But with an FHA loan at 3.5%, your down payment drops to just $12,250. That’s a difference that can put homeownership within reach much sooner than you might think!

Don’t Let Myths Hold You Back

Homeownership is more accessible than many people realize. The key is to get informed about your options and work with a knowledgeable agent who can guide you through the process. Programs and requirements change all the time, and there may be local grants or assistance available to help you even further.

Ready to Explore Your Options?

If you’re curious about what you might qualify for—or just want to bust more real estate myths—reach out! I’m here to help you navigate the path to homeownership, no matter where you’re starting from.

Contact me today to learn more about your real options and take the first step toward your new home!

Recent Posts